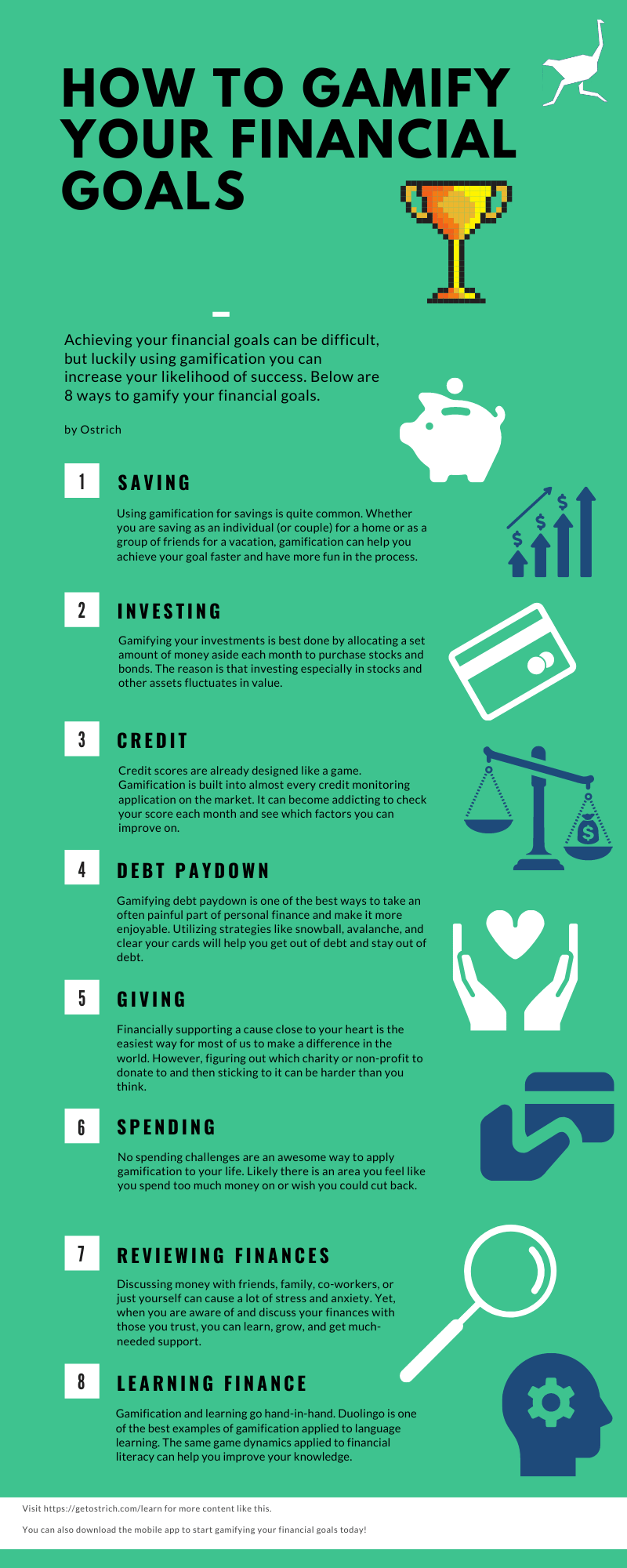

Want to know fun ways to gamify your financial goals and make achieving your financial goals more enjoyable? Then you’ve come to the right place. In this article you’ll learn 8 ways to gamify your financial goals, make personal finance fun and make achieving your goals easier!

What do you mean by “gamifying your financial goals”

Before we get into the ways to gamify your financial goals, if you are confused by what the heck financial gamification is then check out our guide on financial gamification. The cliff notes of that article are that, by using game mechanics such as points, leaderboards, competition with others and a specific set of rules, we can increase motivation for and achievement of financial goals by applying them to personal finance. Plus who doesn’t like a good game?

What part of personal finance can be gamified?

Almost every part of personal finance can be gamified, from saving and investing to credit scores, spending, and even giving. Here are 8 ways to gamify these different areas of personal finance. On the Ostrich app, we have challenges relating to almost all of these areas of finance. We’ve noted the relevant challenges for each making it easy to get started on the Ostrich app.

1. Saving

Using gamification for savings is quite common. Whether you are saving as an individual (or couple) for a home or as a group of friends for a vacation, gamification can help you achieve your goal faster and have more fun in the process. Consider savings goals that are time-bound and have a specific amount. The specific amount could be in total such as saving $1000 in 2 months or saving $200 per paycheck. Additionally, you can use steps such as starting with a smaller amount one month and increasing how much you save month over month.

Savings challenges to explore: 52 Week Money, Penny Saving Challenge, Acquire Then Retire

Additional resources: Saving 101 Guide & the Ultimate Guide to Savings Challenges

2. Investing

Similar to saving, gamifying your investments is best done by allocating a set amount of money aside each month to purchase stocks and bonds. The reason is that investing especially in stocks and other assets fluctuate in value. Rather than focusing on reaching a total amount in a given time focus on consistently investing. We’ve also seen gamification applied to real estate investing. Examples include investors on BiggerPockets gamify the process of researching properties and making offers on both residential and commercial real estate.

Investing challenges to explore: DCA is the Way, The Real Real

Additional resources: Short-Term Investing Guide, Retirement Investing Guide, & Ultimate Guide to Investing Challenges

3. Credit

Credit scores are already designed like a game. Gamification is built into almost every credit monitoring application on the market. It can become addicting to check your score each month and see which factors you can improve on. The key is knowing what makes up your credit score and taking actions to improve those factors.

Check out tools like Credit Karma or Credit Sesame for more information on how to systematically go about improving your credit score, and what kind of score you should be aiming for.

Additional resources: Debt 101 Guide & Ultimate Guide to Debt Challenges

4. Debt Paydown

Gamifying debt paydown is one of the best ways to take an often painful part of personal finance and make it more enjoyable. Utilizing strategies like snowball, avalanche, and clear your cards will help you get out of debt and stay out of debt. If you are feeling too overwhelmed with debt then using a debt consolidation service before you begin a debt paydown challenge is a great way to start.

Debt paydown challenges to explore: Snowball, Double or Nothing, Clear Your Cards, Minnie Me, Avalanche

Additional resources: Debt 101 Guide & Ultimate Guide to Debt Challenges

5. Giving

Financially supporting a cause close to your heart is the easiest way for most of us to make a difference in the world. However, figuring out which charity or non-profit to donate to and then sticking to it can be harder than you think. By applying the same gamification concepts, automating your donations and aiming to exceed your goals where possible, you can make it much easier to donate to causes that you care about. Not sure how best to use your money? Check out Give Well, which analyzes what the most effective charities are to ensure your dollars have the most meaningful impact.

Giving challenges to explore: Don’t Hate Donate, Tit for Tat

Additional resources: Giving 101 Guide

6. Spending

No spending challenges are an awesome way to apply gamification to your life. Likely there is an area you feel like you spend too much money on or wish you could cut back. Acknowledging whether you spent on that thing you’ve been trying to cut back is extremely effective and rewarding. As humans, we love checking off things on our to-do list and seeing progress. That is where gamifying your spending becomes a really powerful tool in your toolbox.

Spending challenges to explore: Drop It Like Its Hot, Stop Shop & Roll, Frugal Fall, & Category Blackout.

Additional resources: Budgeting Guide & Ultimate Guide to No Spending Challenges.

7. Discussing and Reviewing Your Finances

Discussing money with friends, family, co-workers, or just yourself can cause a lot of stress and anxiety. Yet, when you are aware of and discuss your finances with those you trust, you can learn, grow, and get much-needed support. Using gamification strategies like Sunday Scaries to talk about money is another great application in personal finance.

Challenges to explore: Sunday Scaries

Additional resources: Financial Goal Setting Guide

8. Learning Finance

Gamification and learning go hand-in-hand. DuoLingo is one of the best examples of gamificaiton applied to language learning. Their system is super effective and Ostrich Co-Founder, William Glass is a big fan. The same game dynamics applied to financial literacy can help you improve your knowledge.

Action: Challenge yourself to add a new finance podcast, order (or rent from the library) a finance book, or check out Ostrich’s Financial Guides and earn rewards on the app.

Conclusion

There are many ways to gamify your financial goals, the key is knowing what your goals are in order to get started. Luckily with the Ostrich App, gamifying your finances is incredibly simple! You can get started with one of our challenges in less than 2 minutes after you download the application, all without having to link your bank account.