What does financial gamification mean, and why does financial gamification work? In the Ultimate Guide to Financial Gamification we answer all your questions. For context, Ostrich gamifies finances enabling you to achieve your financial goals using our four-step “Ostrich Method”! It’s safe to say we know a thing or two about financial gamification. Now to the guide!

What is Gamification?

Gamification is applying the elements of a game – points, competition with others, and a specific set of rules – to your life in order to increase the desire and ability to achieve objectives.

At Ostrich, we use financial gamification with the objective of enabling members of our Flock to achieve their financial goals. Gamification in finance up to now has mostly been very specific. Credit scores and various debt paydown strategies would be two examples.

However, we believe that applying gamification more broadly to personal finances has a transformative effect on improving society’s financial situation.

Examples of Gamification in Day-to-Day Life

There are many examples of gamification that you encounter on a day-to-day basis, but may not even recognize as gamification. Perhaps the most common one is a loyalty program, say airline miles.

As you purchase flights, you accrue miles or points with an airline loyalty program. You can then redeem those points for rewards ranging from a free checked bag to a free flight.

The more flights you buy leads to a higher status with the airline, which leads to a better redemption rate on your points. More flights = leveling up to a better status.

To keep customers coming back to their stores, companies in all industries use loyalty programs. The rewards are important but almost equally important is the process of building up points to “earn” those rewards. This makes you feel good as you work towards a goal and then achieve it

McDonald’s Monopoly Game

McDonald’s Monopoly is an even more obvious version of gamification, literally turning buying food into a game of Monopoly where customers collect “properties”. Eventually, we discovered that the whole game was rigged! But that didn’t stop McDonald’s from bringing Monopoly back because the game was so effective at getting McDonald’s customers to buy more of their food.

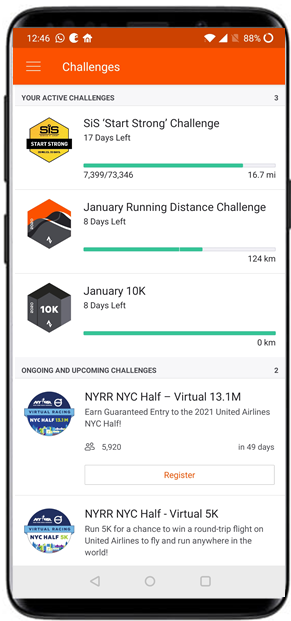

Strava’s Fitness Challenges

To take a more modern, app-based example, Strava uses a gamified process to enable its users to work on their fitness. Users can compete together in different fitness disciplines, earn achievements by competing and even rewards as part of challenges.

Why is Financial Gamification Important?

When used correctly, gamification in personal finance is a powerful tool that will help you achieve your financial goals. The three main benefits are:

Increased Motivation

Financial gamification increases your motivation to achieve your goals resulting in quicker and more sustained progress towards your goals. This motivation comes from the use of points, leaderboards, and rewards that help you across all areas of personal finance from saving and investing to debt reduction, spending, and giving.

Clear Path to Success

Gamification provides structure and a clear path for achieving your financial goals. You’ll know where you stand as you progress towards your financial goals. Plus if you slip up, gamification provides a way to get back on track. Once you’re on your path, you can focus on the information, tools, and actions that will help you achieve the next milestone, and ultimately, your goal.

Less Stress and Anxiety

Financial gamification removes the feeling of information overwhelm, financial stress, and anxiety. By narrowing your focus to the information needed to achieve your next milestone, financial success feels accessible regardless of your current financial situation or knowledge of finances.

If you are struggling to achieve your financial goals, then using financial gamification could be the solution.

How Financial Gamification Works

Financial gamification takes those game-like dynamics such as points, leaderboards, and badges, and applies them to your financial goals. This is something that we do across every aspect of finance at Ostrich, including saving, investing, paying off debt, reducing spending, giving to charity, and even just talking about your finances. Our challenges are designed to make working towards your goals easier.

Examples of Financial Gamification in Day to Day Life

There are many examples of gamification in personal finance. Two examples that really stick out involve the snowball debt reduction strategy and credit scores.

Snowball Method

The snowball strategy is one of the most well-known examples of gamification in finance. Dave Ramsey, an established finance expert, is one of the snowball strategy’s loudest proponents. The snowball strategy provides a clear pathway to freeing yourself from debt. This strategy applies basic game dynamics such as a scoreboard, structure, and rewards.

Debt Snowball Strategy

To set up a snowball strategy, you first rank all of your debt based on the dollar amount owed. You then pay the minimum monthly payment on all of your debt except the loan with the smallest balance.

Whatever extra money you have, you put towards lowering the balance of your smallest piece of debt.

This allows you to build momentum as you pay down your smallest loan first and then move on to your next smallest piece of debt.

You repeat this until you are debt-free. Each time you pay off a debt you are leveling up just like in a game. The rewards you receive are psychological in addition to monetary, with your brain releasing dopamine each time you pay down another piece of debt.

Credit Scores

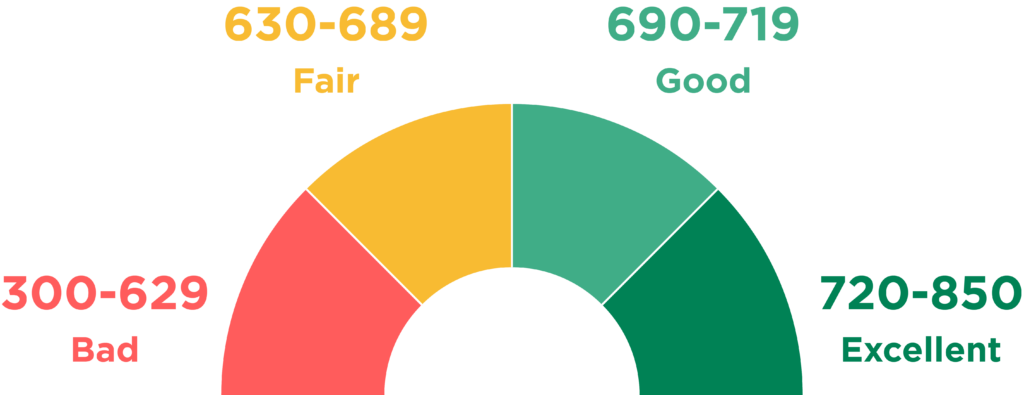

The second example of gamification in finance is credit scores. Credit scores were designed to make it easier for lenders to give loans to strangers. Since it is impractical for a bank to get to know each individual person before giving them a loan, banks need a way to determine who will pay them back.

Credit scores were born out of this need and use a number of factors to determine your score. These scores use game dynamics like points, tasks, leaderboards, and rewards.

As the name suggests, credit scores are actual scores or numbers representing how likely you are to pay back a loan. Just like a good game, lenders have a range of credit scores that represent levels. As you level up your likelihood of receiving a loan on better terms increases.

Credit scores are based on a set of factors or tasks that impact your overall score. When first starting out, you have no score until you complete enough of these “tasks” like making all of your payments on time consistently, or maintaining low utilization.

The average American’s credit score rose 22 points from 689 in 2010 to 711 in 2020. This rise coincided with companies like Credit Karma sharing how the credit scores work. Through visually showing your rank on a score dashboard and seeing which factors you can improve, gamification has proven to be very effective for improving credit scores.

How to Gamify Your Finances?

You can gamify your finances using a few different methods that require varying levels of effort.

The Old Fashioned Way

The most intensive approach is DIY (do it yourself), using manual methods such as pen and paper to create your own challenges. You can track your goals and mark progress on a whiteboard or notebook as you go. The book, Your Money or Your Life, which popularized the Financial Independence Retire Early community, is an advocate of the pen and paper method for budget tracking.

DIY Digital

The next option when it comes to gamifying your finances is the DIY digital method using existing tools and communities. One example is a group text for friends that are saving for a vacation together. Another would be creating your own excel spreadsheet to crunch numbers, points, and achievements.

While the DIY financial gamification methods can be very effective, they do require more setup and maintenance. They can also be tough to stick with because of the time-consuming, self-driven nature of tracking.

Financial Gamification Tools

The most effective way to gamify your finances is to utilize technology tools like Ostrich, Credit Karma or other financial gamification apps.

As an example, Ostrich aligns gamified financial challenges to your financial goals across multiple areas of personal finance. This makes it easy to join pre-built challenges for those looking to get started quickly or to create your own custom challenges.

Using existing financial tools makes it easier for you to get started on improving your finances through gamification.

Check out 8 Ways to Gamify Your Financial Goals for a more tactical guide on gamifying personal finance.

Conclusion

Gamifying finance is a powerful way to achieve your financial goals when used properly. Financial gamification uses game dynamics such as points, leaderboards, badges, and results to increase motivation, provide a structure for achievement, and effortlessly track progress. To get started, you can go the DIY route or, take the easier road with tools like Ostrich.