Saving money can be tough, but the Penny Challenge makes it so much easier – all you need to get started is a penny! The Penny Challenge is a daily savings challenge that starts with just $0.01. No excuses for this beginner’s savings challenge!

What is the Penny Challenge?

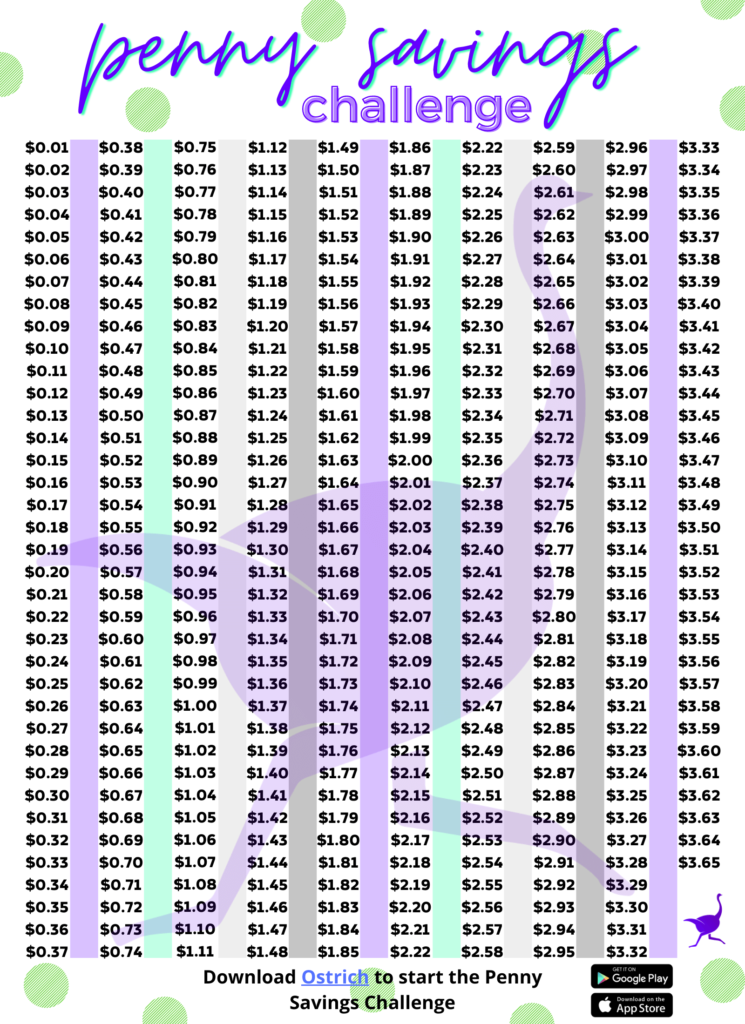

The Penny Challenge is incredibly simple. Start with a penny on Day 1 and every day save an extra penny. On Day 2 save $0.02, Day 3 save $0.03 and so on. On Day 90 you’ll save $.90. By the end of the year you’ll have saved $667.95! The highest amount you will need to save on the last day is $3.65.

If you don’t believe you have the ability to save money, don’t make enough, or can’t afford the luxury then this is the place to start. By starting with just $0.01 and bumping it up by a penny each day, you quickly build up confidence and develop a savings habit.

At the end of this challenge you’ll have saved almost $700 and will have embarked on your wealth-building journey.

If you’re already dreaming bigger and $0.01 is too small a starting amount, begin with a larger base amount and go from there!

When is the best time to start?

The best time to start the Penny Challenge is today. Waiting until January 1st or the start of the month may feel like it makes sense, but what are you gaining by waiting? Plus by starting today, you’ll be able to take advantage of the law of compounding interest that will help your savings grow beyond the $667 you’ll save during this challenge.

Who is the Penny savings challenge for?

The Penny Challenge is perfect for anyone just getting started building up their savings, or as a way to work towards a specific savings goal. By starting small you build both the habit of saving and momentum to propel you towards your financial goals. This challenge is suitable for both people who tend to use cash and those who bank electronically.

No matter your income level you can customize the challenge to fit your financial goals. Invite your friends to join you on Ostrich and achieve your money goals together.

Are you ready to save some money and build your nest egg?

You can sign-up for Penny Challenge on the Ostrich app.

How to implement the Penny saving challenge

Step 1

Sign-up for the Penny Challenge on Ostrich.

Step 2

Print out or save the Penny Challenge calendar.

Step 3

Each day increase your amount saved by just once cent and set it aside in a special jar or savings account.

BONUS

Use a high-yield savings account to make the most interest on your savings. If you are using cash, at the end of each week or month take the cash you’ve saved and deposit it in your high-yield savings account.

Step 4

Check-in with Ostrich daily and watch your wealth grow!

Don’t get discouraged if you forget a day. Life happens! Just catch up the following day and keep saving!

Tips for saving more money

Here are some money-saving tips to help you during the 52 Week Money Challenge!

Pay yourself first

Whether you have a defined budget or not, the key to hitting your savings targets is to pay yourself first. Immediately, when you get income, set aside money towards the Penny Challenge. If you don’t pay yourself first, no one else will.

Sell your old things

You probably have some things you either bought and never used or only lightly used. Whether it’s that new outfit that looked great online but not so much in person, or old electronics you don’t use anymore. Hop on Facebook Marketplace, eBay or Amazon and list those suckers.

Cut out expenses

This is one of the simplest ways to increase your savings but it isn’t always easy. Find unused subscriptions to cancel, or things you can live without. As the Penny Challenge is a year-long challenge, try cutting back on larger expenses such as rent or transportation costs. You can join a no spending challenge on Ostrich if you want to join others who are also cutting back on spending.

Go couch cushion surfing or junk draw scavenging

Loose change often slips through the cracks… literally. Be sure to check your couch cushions, junk drawer and car for hidden coins that may have slipped away. Also don’t be too proud to pick up the lone penny on the street.

What to do with your newfound savings

Pay down debt

Debt drains both your bank account and you, psychologically. Pay off high-interest rate credit card debt, payday loans, or other forms of revolving debt. Join a debt paydown challenge and try implementing one of the snowball or avalanche debt reduction methods to stay motivated.

Build your emergency fund

It’s important to have at least a few months’ worth (6 months is considered healthy) of living expenses built up. This provides a cushion for your quality of life in case you lose your income. If you feel like 6 months isn’t enough try building your savings to the level of your annual salary or until you feel comfortable.

Invest for the long-term

Another great use of your new savings is to invest. Research shows that investing for the long-term (10+ years) is the way to go when building wealth. We recommend getting started with low-cost index funds vs. purchasing individual stocks and using the dollar cost average investing method. Check out our favorite brokerage accounts and our favorite auto investing tools.

Make an important purchase

Once you’ve built up your emergency fund and started investing, use that extra Penny Challenge money to make an important purchase. Don’t just spend the money for the sake of it – look for things that truly bring you fulfillment.

Make a small calculated bet

Investing for the long-term is proven to be the most sure-fire and safe way to build wealth, but it can be boring. Boring is good for your major goals. We like boring! But if you have a little extra money after making your boring investments and you are okay with losing a small amount of money, explore alternative moonshot investments. This could be anything from investing in cryptocurrency, NFTs, startups, art, collectibles, or that penny stock. The key is not to make this your main strategy. Never invest more than you can afford to lose not just financially, but also psychologically.

Benefits of the Penny Savings Challenge

There are many benefits from completing the Penny Challenge. Who doesn’t want more money in their pockets?

Building Your Saving Muscle

Saving money isn’t always easy. It can be tough with the constant ads, one-click purchasing, and temptations to spend everywhere you look. By consistently saving week over week you’ll start to see that it is possible to save money without sacrificing your quality of life.

Upping your challenge

After completing the Penny Challenge you’ll be motivated to see how much more you can save. You’ll be primed to start saving even more of your hard-earned money.

Feel good

Hitting your goals releases dopamine to your brain, giving you that feel-good high. You’ll legitimately feel accomplished for achieving your savings goal and your brain will want more. Ultimately the desire to feel that way again will motivate you to save more and take on larger financial goals.

Tools to get there quicker

High-Yield Savings Account

Open up a separate high-yield savings account in order to earn the most interest on your savings. See the tools page for the best high-yield accounts today.

Automation

Log into your checking account and create an automatic weekly transfer to your new Penny Challenge savings account. This will make your life a lot easier, and you can always adjust your automated transfers whenever you’d like.

Related savings challenges to the Penny Challenge include: Our Love is Priceless, 52 Week Money, Acquire Then Retire, and Drop It Like It’s Hot.

Conclusion

The Penny Challenge is a great way to start saving money, building momentum, and the habit of paying yourself everyday. It’s great for those just starting out or anyone looking to accumulate their loose change. Get started today on Ostrich and invite your friends and family to join you.